Nc Sales Tax Calculator

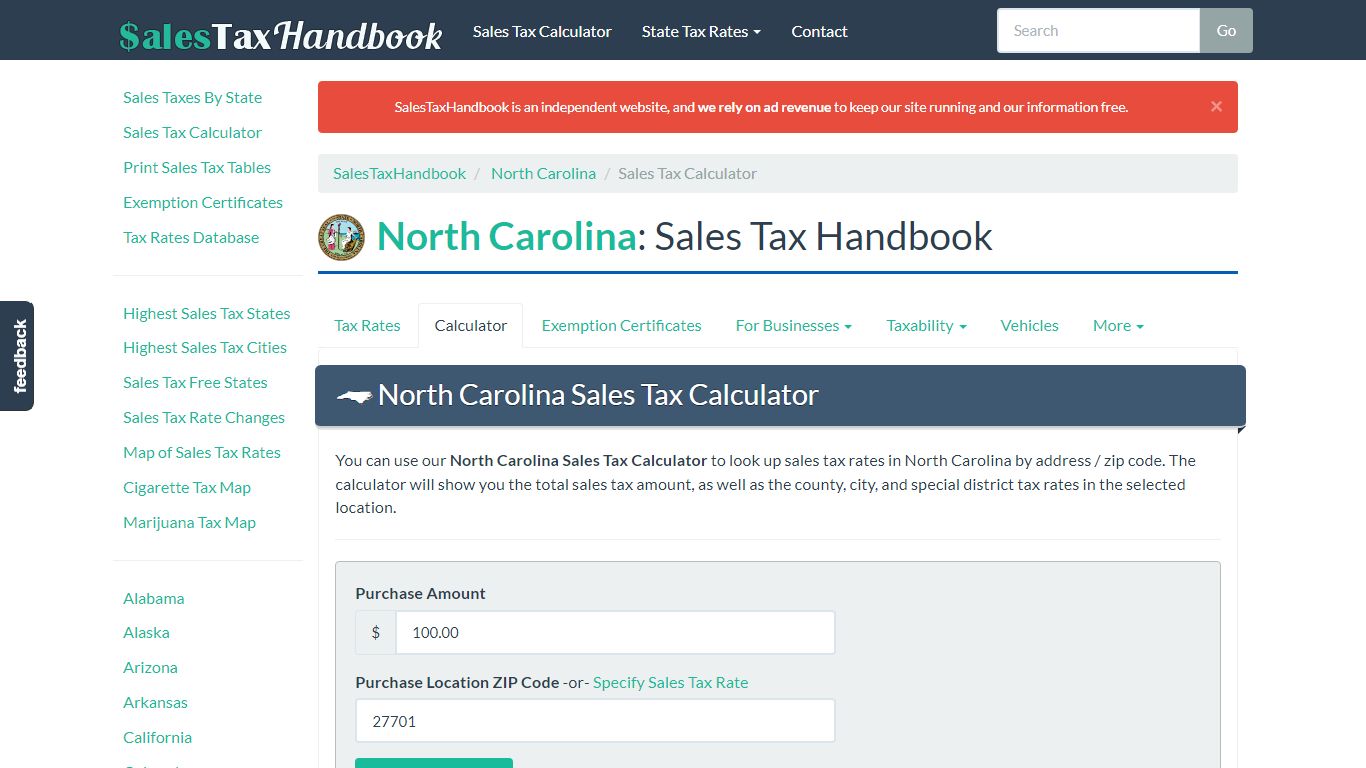

North Carolina Sales Tax Calculator - SalesTaxHandbook

You can use our North Carolina Sales Tax Calculator to look up sales tax rates in North Carolina by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/north-carolina/calculator

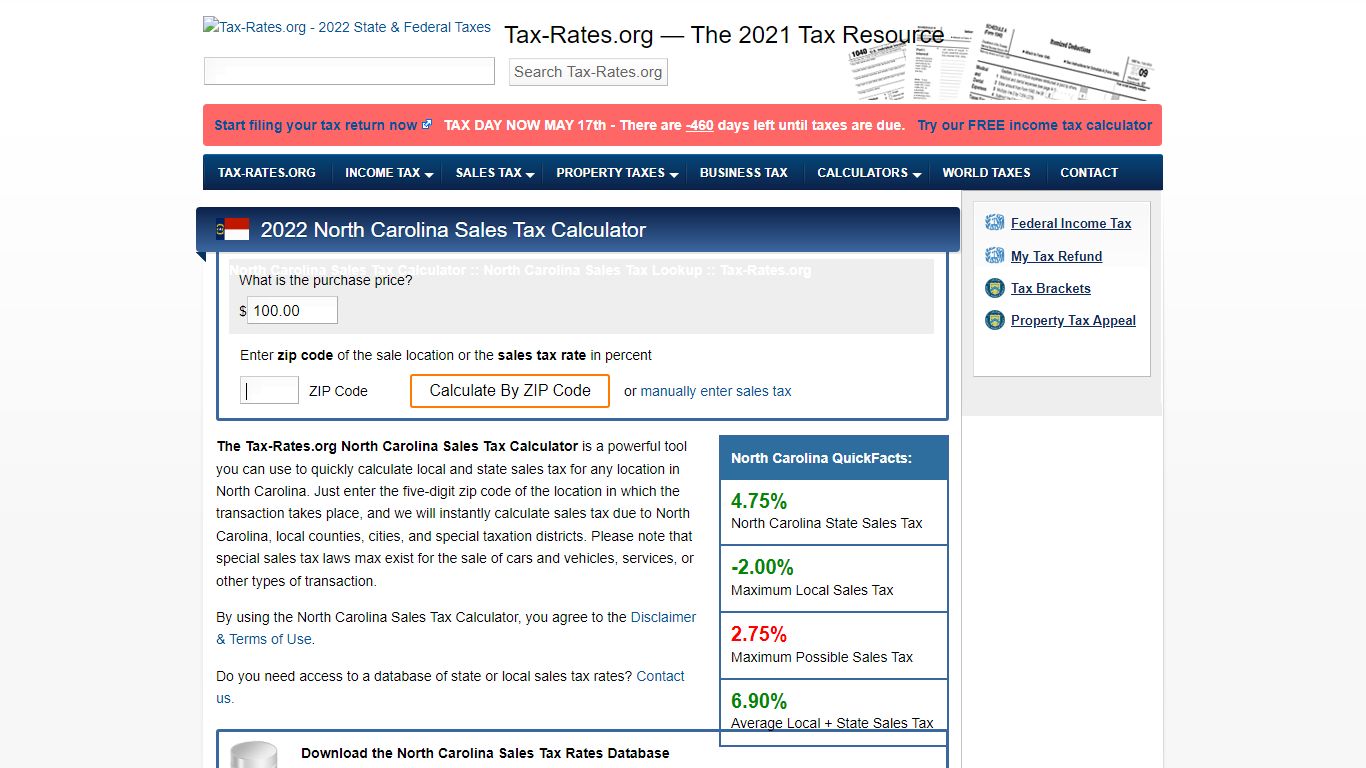

North Carolina Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to North Carolina, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/north_carolina/sales-tax-calculator

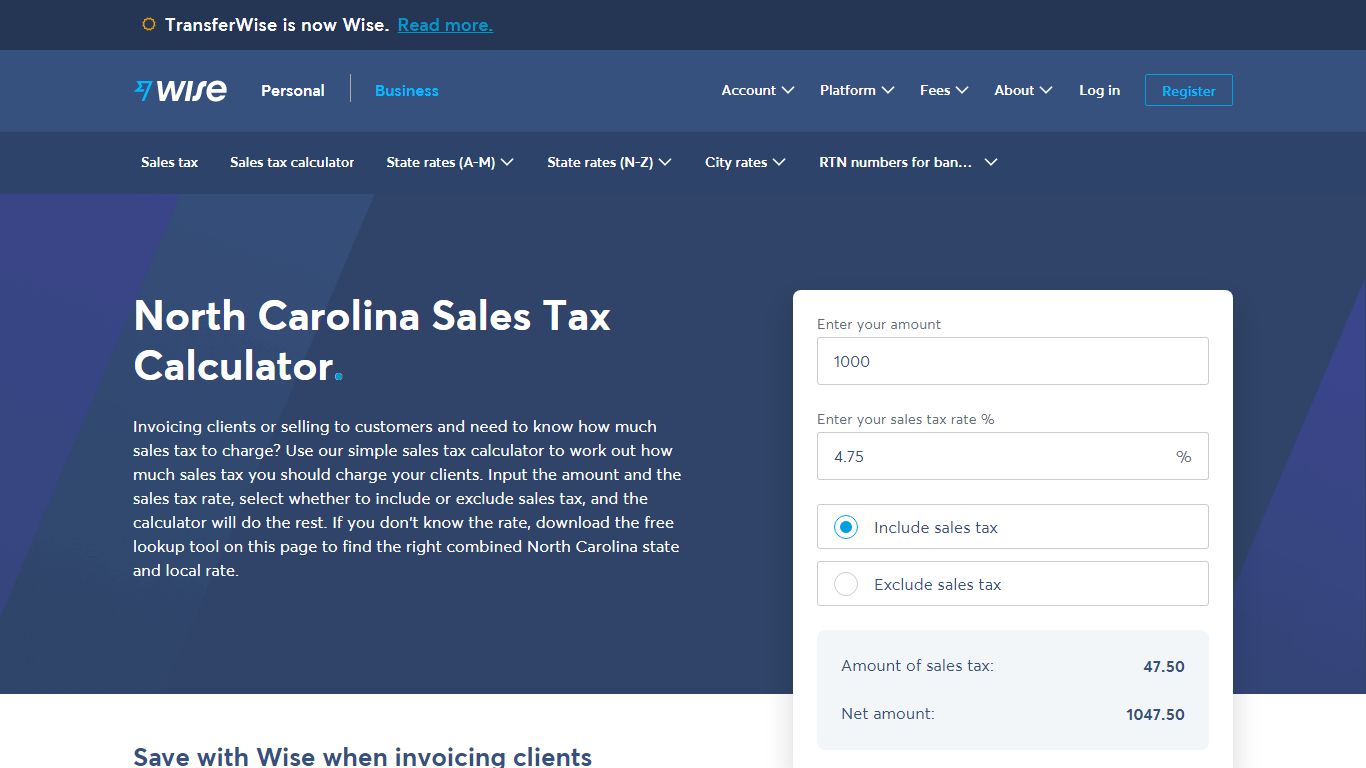

North Carolina Sales Tax | Calculator and Local Rates | 2021

The base state sales tax rate in North Carolina is 4.75%. Local tax rates in North Carolina range from 0% to 2.75%, making the sales tax range in North Carolina 4.75% to 7.5%. Find your North Carolina combined state and local tax rate.

https://wise.com/us/business/sales-tax/north-carolina

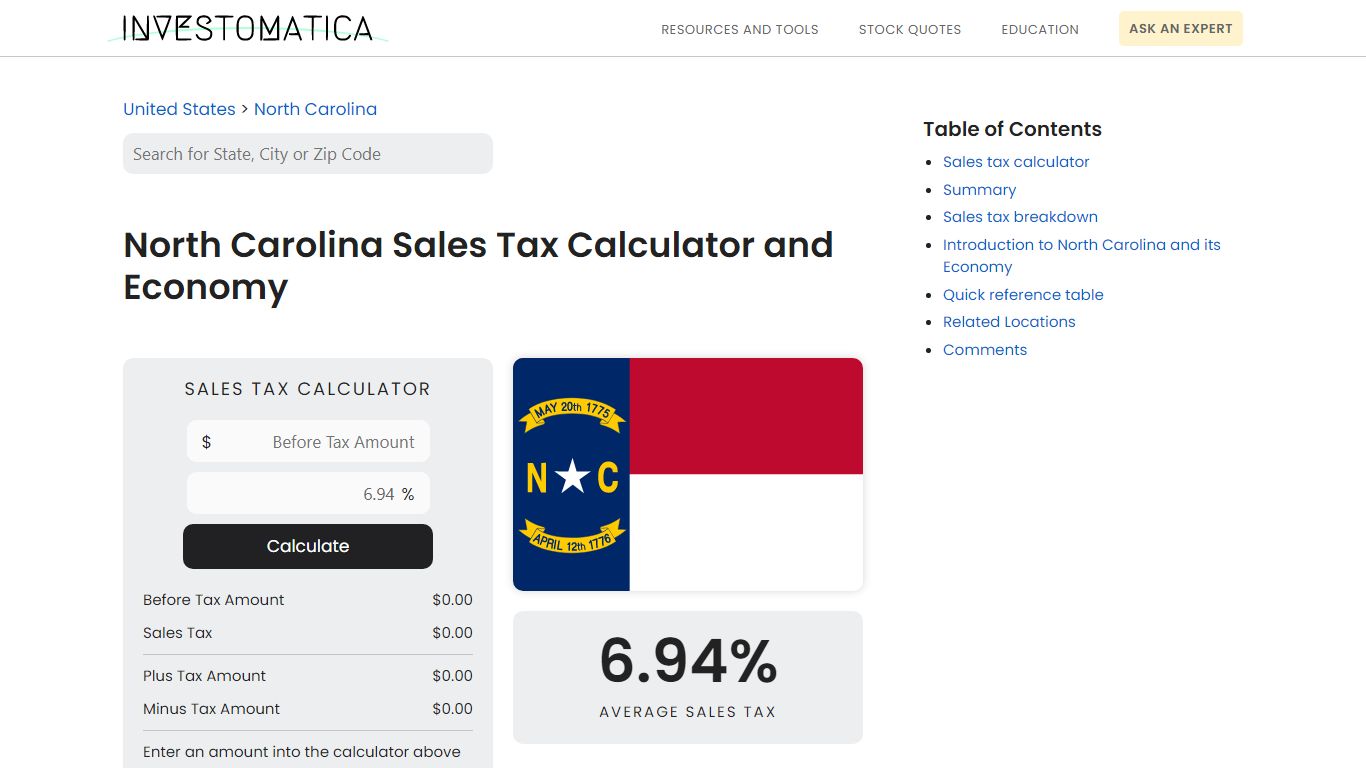

North Carolina Sales Tax Calculator and Economy (2022)

Enter an amount into the calculator above to find out how what kind of sales tax you'll see in North Carolina. You'll then get results that can help provide you a better idea of what to expect. 6.94% Average Sales Tax Summary The average cumulative sales tax rate in the state of North Carolina is 6.94%.

https://investomatica.com/sales-tax/united-states/north-carolina

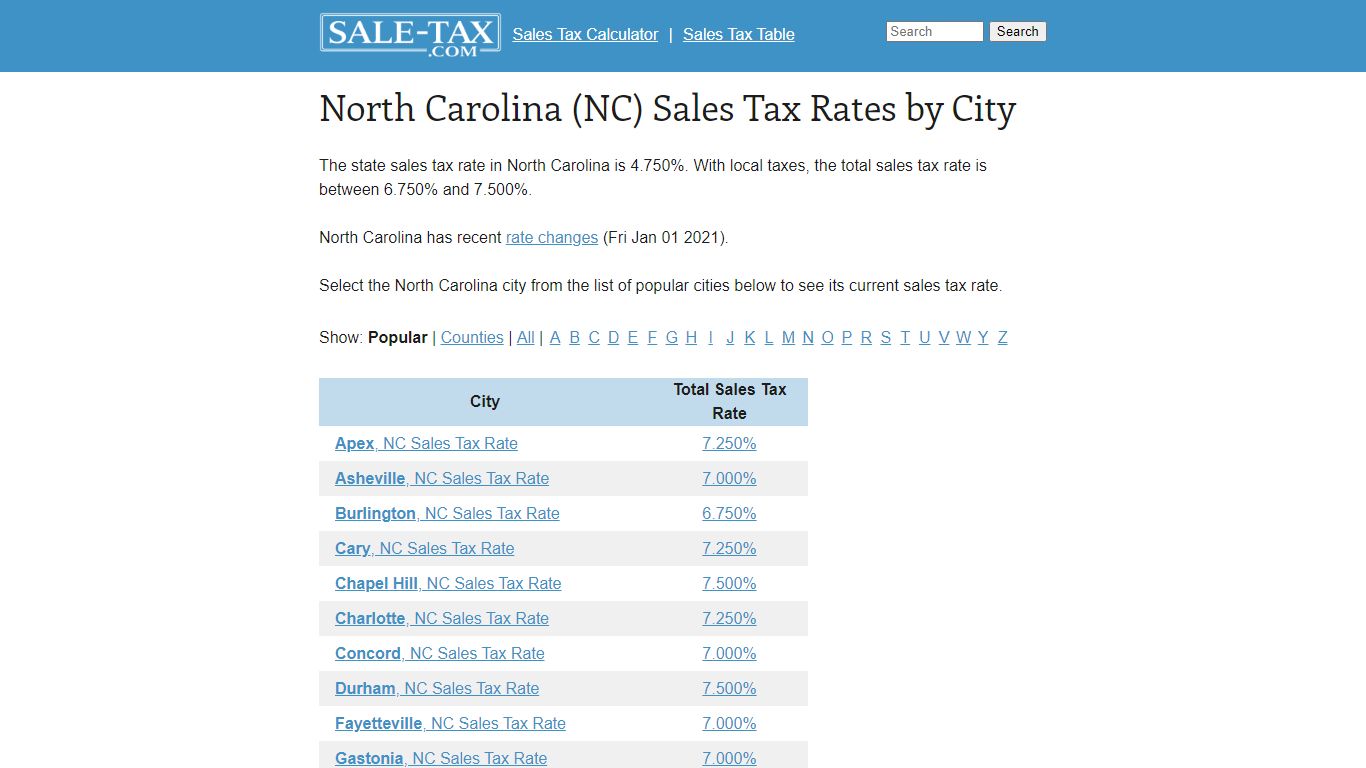

North Carolina (NC) Sales Tax Rates by City - Sale-tax.com

North Carolina (NC) Sales Tax Rates by City The state sales tax rate in North Carolina is 4.750%. With local taxes, the total sales tax rate is between 6.750% and 7.500%. North Carolina has recent rate changes (Fri Jan 01 2021). Select the North Carolina city from the list of popular cities below to see its current sales tax rate.

https://www.sale-tax.com/NorthCarolina

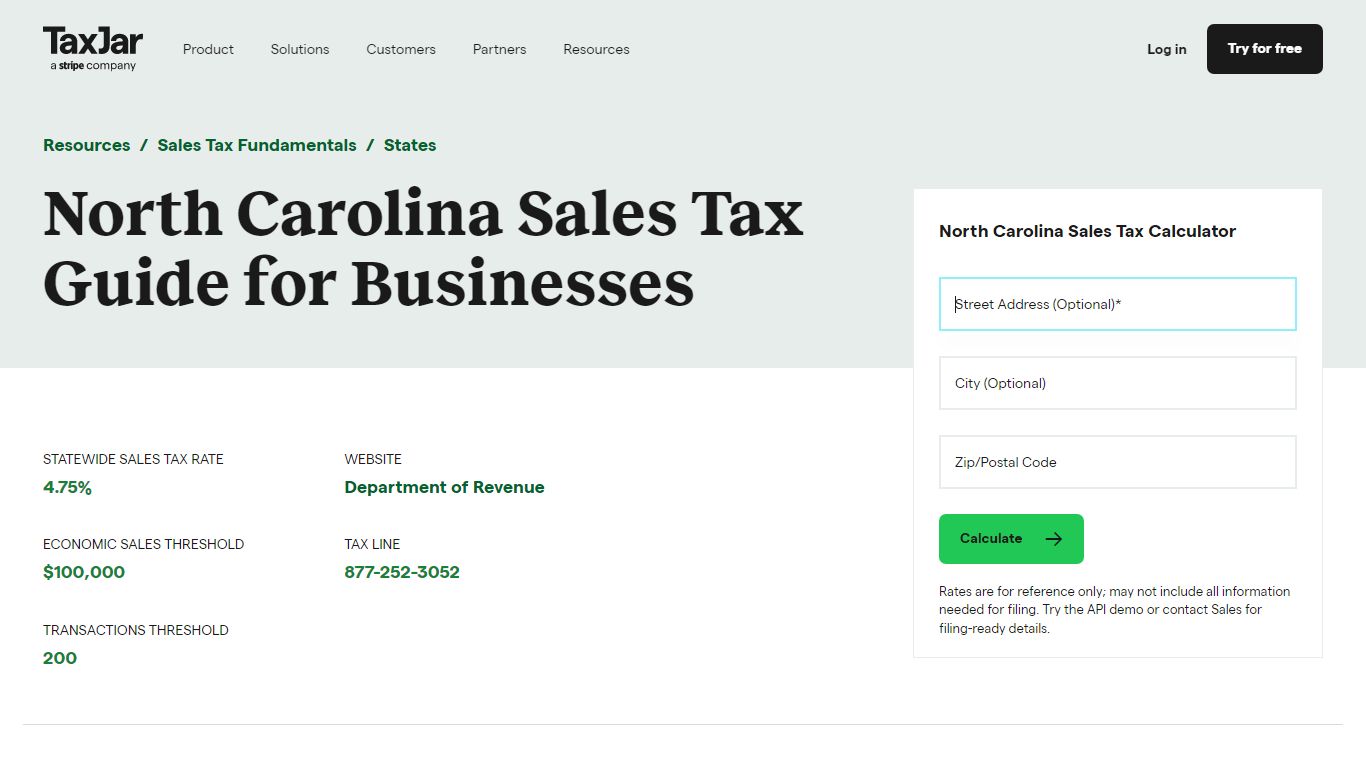

North Carolina Sales Tax Guide and Calculator 2022 - TaxJar

Collecting Sales Tax. North Carolina is a destination-based sales tax state. So if you live in North Carolina, you collect sales tax at the rate of your buyer’s location. You can look up North Carolina’s local sales tax rates with TaxJar’s Sales Tax Calculator, including those for counties such as Durham, Buncombe and Cabarrus.

https://www.taxjar.com/sales-tax/north-carolina

Sales and Use Tax | NCDOR

» Sales and Use Tax Sales and Use Tax. NOTICE: The information included on this website is to be used only as a guide. It is not intended to cover all provisions of the law or every taxpayer's specific circumstances. ... North Carolina Department of Revenue. PO Box 25000 Raleigh, NC 27640-0640. General information: 1-877-252-3052. Individual ...

https://www.ncdor.gov/taxes-forms/sales-and-use-tax

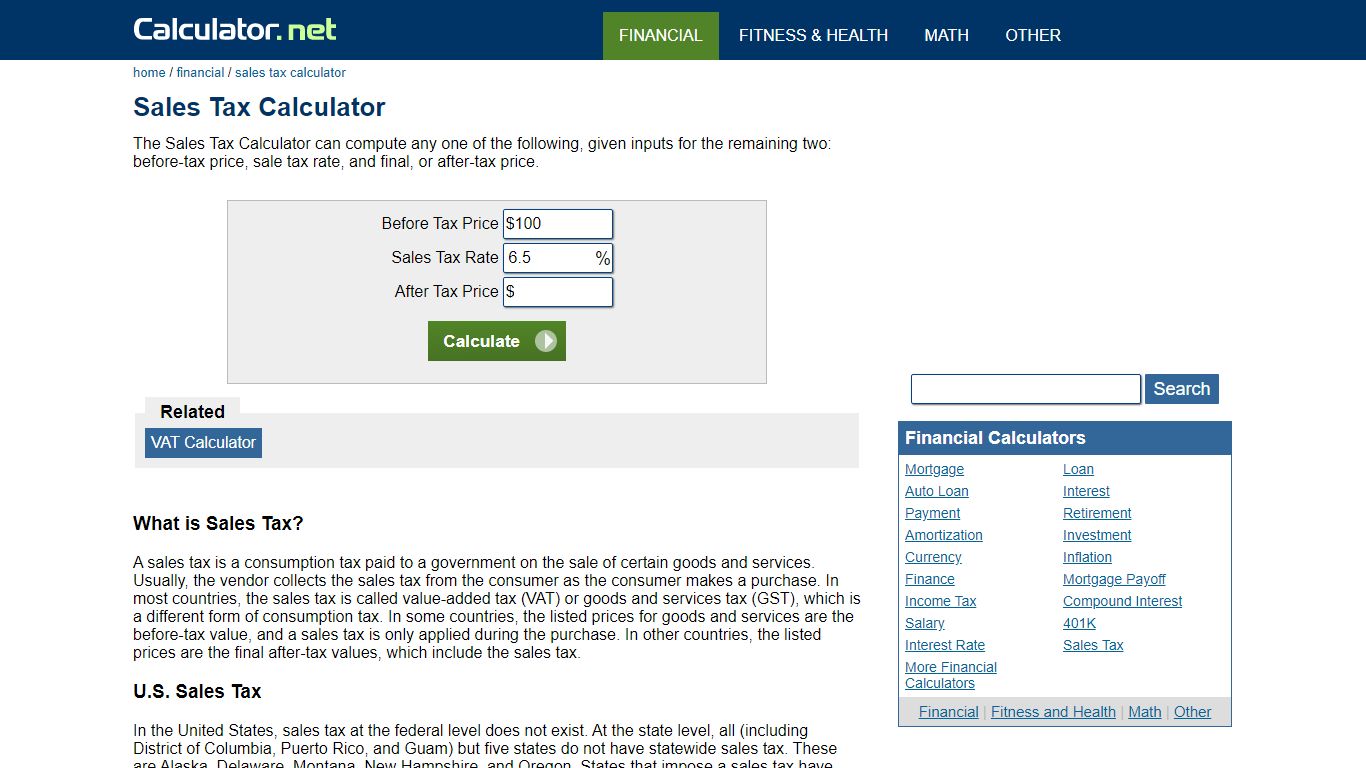

Sales Tax Calculator

The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax? A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

https://www.calculator.net/sales-tax-calculator.html

North Carolina Sales Tax Table for 2022

This is a printable North Carolina sales tax table, by sale amount, which can be customized by sales tax rate. This chart can be used to easily calculate North Carolina sales taxes. ... A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the ...

https://www.salestaxhandbook.com/north-carolina/sales-tax-table?rate=4.75&increment=0.2&starting=1030.6

North Carolina Vehicle Sales Tax & Fees [+Calculator]

To calculate the sales tax on your vehicle, find the total sales tax fee for the city and/or county. In North Carolina, it will always be at 3%. Multiply the vehicle price (after any trade-ins but before incentives) by the sales tax fee. For example, imagine you are purchasing a vehicle for $30,000 with a highway-use tax of 3%.

https://www.findthebestcarprice.com/north-carolina-vehicle-sales-tax-fees/![North Carolina Vehicle Sales Tax & Fees [+Calculator]](./screenshots/nc-sales-tax-calculator/9.jpg)